Understanding A Net Price Estimate

How accurate is the Net Price Calculator?

The Net Price Calculator is meant to provide a quick and directionally accurate estimate. It is designed for use by a broad audience and doesn't take into account all of your unique circumstances - something that our Financial Aid Committee can do. The NPC assumes a typical United States cost of living and tax structure, so those living in an area with a lower cost of living, or those who pay lower than average income, state, or local taxes for their overall income will find that it is less accurate for them. Families with significant wealth will also find that the calculator is less accurate for them.

The NPC estimate is only as good as the information you input. The most common mistake in filling out the NPC is to forget to include untaxed income like income that you defer to tax-deferred retirement accounts. Another common mistake is to subtract taxes from the income that you input in the NPC. The NPC asks for pre-tax income - it assumes taxes as part of the calculation, and so subtracting your taxes from the NPC will give you a less accurate estimate.

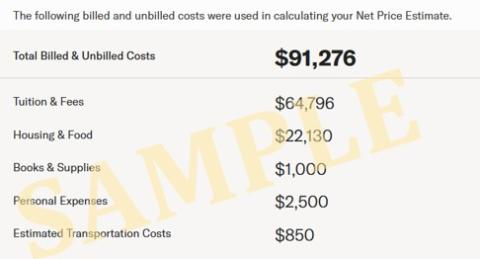

Cost of Attendance

When we are putting together a financial aid package, we start with a total cost of attendance. This number reflects the total cost for a student to attend Harvard for the academic year, and includes both billed and unbilled costs. Billed costs are costs which are charged by Harvard, such as tuition and fees, and housing and food, and which will appear on your student bill. Unbilled costs are estimates of expenses that you will pay for on your own, including travel to and from campus, and books and personal expenses. We know that you will need to spend money on these items, but we don't actually provide them to you or send you a bill for them.

Billed expenses are also called direct costs. Unbilled expenses are also called indirect costs or out-of-pocket expenses.

The categories that make up the standard cost of attendance are:

Tuition & Fees: This represents tuition as well as standard, required fees for the academic year (two semesters).

Housing & Food: Housing (also known as Room) represents the standard cost of housing at Harvard. All students are charged the same housing fee - we do not offer tiered housing options. Food (also known as Board) represents the fee for the meal program. There is only one meal program, which provides access to three meals a day. Students are able to eat in several dining halls and are welcome to eat as much as they'd like at each meal.

Transportation: The transportation allowance is an estimate of the cost of travel from home to Harvard and back again. It's included in your cost of attendance, but you pay for it out-of-pocket. The amount of the transportation allowance is based on where you live.

Books & Personal Expenses: Books represents the cost of books, course materials, supplies, and equipment that you can expect to pay for out-of-pocket for two semesters of Harvard classes. Personal expenses are out-of-pocket expenses for things such as laundry, toiletries, and other things which you may buy for yourself over the course of the year.

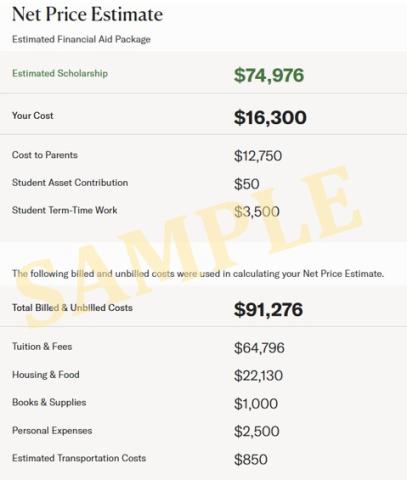

Family Contribution

Please note: the Net Price Estimate and Scholarship amounts displayed here are generic examples and do not reflect the results of your own personal net price estimate.

The estimated family contribution is broken down into three categories:

Parent Contribution: The parent contribution is based on our assessment of your parent(s)' ability to pay, based on the income and asset information that you entered on the Net Price Calculator.

Student Asset Contribution: The student asset contribution represents about 5% from your student assets.

Student Term-Time Work Expectation: The student term-time work expectation is a standard amount included in all financial aid packages. Most students will work roughly 10-12 hours per week for a minimum rate of $14.25 per hour.

Estimated Scholarship

The estimated scholarship is the total cost of attendance minus the total family contribution. We use a combination of federal, state, and Harvard funds to make up the total scholarship amount.

Frequently Asked Questions

Understanding Your Financial Aid Estimate FAQs

-

No, the work expectation is not a billed cost but rather an expectation that you will contribute to your college expenses. Most students work to meet their student contribution, and jobs on campus are plentiful and varied. Some students use outside awards or loans to meet their expected contributions. If you can't save up enough for your student contribution, the Harvard Loan program may be able to help.

-

No. Families receive only one bill. The bill includes the charges for billed expenses minus your total scholarships. If you choose to work, those earnings will be paid directly to you to use as you wish. You could use them to pay your student bill, or you could use them on unbilled costs like travel, and personal expenses.

-

The Net Price Calculator is only intended to provide a quick estimate. As part of the formal financial aid application you will have an opportunity to explain any special financial circumstances that your family faces. Financial aid applications are reviewed by the members of our Financial Aid Committee - not a computer.

-

The Net Price Calculator is very accurate, but it is only as good as the information that you input. The most common mistake in filling out the NPC is to forget to include untaxed income like income that you defer to tax-deferred retirement accounts.

Another common mistake is to subtract taxes from the income that you input in the NPC. The NPC asks for pre-tax income - it assumes taxes as part of the calculation, and so subtracting your taxes from the NPC will give you a less accurate estimate.

And of course the Net Price Calculator is only intended to provide a quick estimate and can't take into account all of your unique circumstances - something that our Financial Aid Committee can do.

-

Your Net Price Estimate is for one year (two academic terms) at Harvard. Students reapply for aid each year, and update our office with the latest information about their family income and assets. If your financial circumstances are similar throughout your time at Harvard, you can expect your financial aid package to remain similar.

-

A large percentage of each entering first-year class receives one or more outside awards from national or local organizations. When adjusting the Harvard financial aid package, 100% of the total outside award amount is first deducted from your work expectation. If the total of outside awards exceeds your work expectation, that excess amount is deducted from the Harvard Scholarship. Since outside awards are additional resources that help to meet need, they may not be used to replace your parents' contribution or other expected family resource. For example, if you were originally offered a financial aid package with a $3,500 job, and a $15,000 Harvard Scholarship and subsequently receive a $2,000 National Merit award and $1,000 from the Elks Club, then we will reduce your term-time job expectation to $500. Only if outside awards exceeded $3,500 would they have any impact upon the amount of Harvard Scholarship.

-

Yes, each parent and their household will complete a CSS Profile and submit tax documentation (only your custodial household needs to submit the FAFSA). We feel strongly that both parents have an obligation to support you, and a divorce or separation does not change that obligation. We look at each case individually, and we make every effort to be sensitive to particular family circumstances when deciding how much to ask from each parent. If either parent is remarried, financial information about their new spouse and dependents, if any, should be provided. In this way we obtain the fullest possible picture of your financial background and can make the fairest judgment about your need for assistance. If we have received financial information from both your parents, the figure listed as "parent contribution" on your award letter will be the combined figure for your parent 1 and parent 2, determined by doing a separate need analysis for each. It is up to you and your parents to decide how to divide the responsibility for paying the termbills.